Taxes on paycheck in georgia

This guide is used to explain the guidelines for Withholding Taxes. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB.

If I Live In Georgia How Much Of My Paycheck Goes To Lazy People Who Won T Get A Job By Glenn Stovall Medium

Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

. Single filers who earn more than this amount have. Go to the Georgia Tax Center. 18 rows Brief summary.

Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Use the Georgia salary calculator. Taxpayers now can search for their 1099-G and 1099-INT on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals.

What is the Georgia income tax rate for 2020. Georgia income tax rate. All Georgia employers must withhold.

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. With six different tax brackets payroll in Georgia is especially progressive meaning the more your employees make the more they have to pay. For your ID Type select the box.

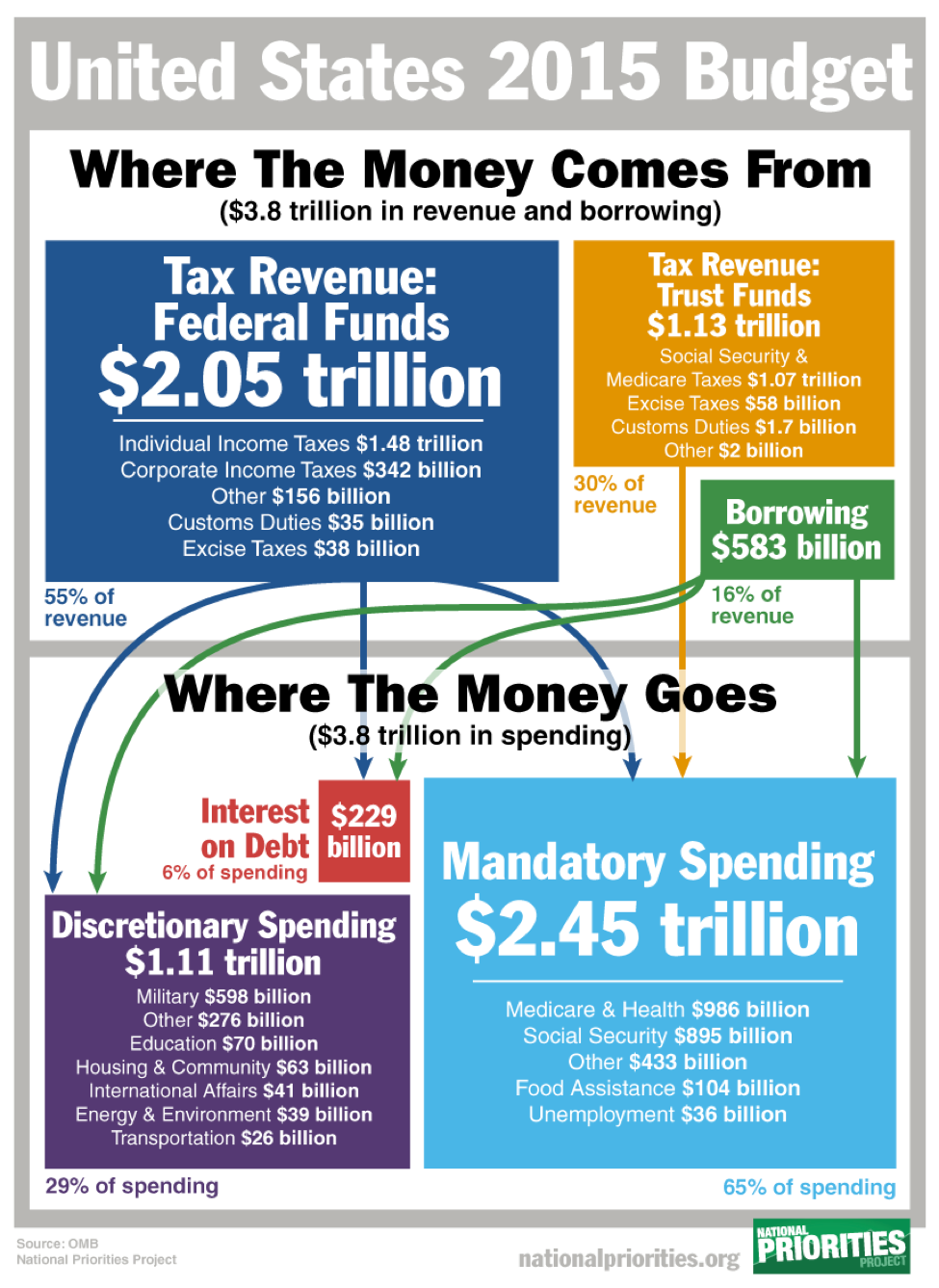

For Customer Type select on Individual. In Georgia payroll taxes consists of payments towards medical care tax unemployment tax social security tax state income tax and Federal Income tax. 4 rows Georgia Income Taxes Georgia utilizes a relatively simple progressive income tax system.

The income tax rate ranges from 1 to 575. Census Bureau Number of cities that have local income taxes. Georgia Individual Income Tax is based on the taxpayers federal adjusted gross income adjustments that are required by Georgia law and the taxpayers filing requirements.

This includes tax withheld from. This means that higher income is taxed at a higher rate. From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages.

To qualify for a 12000 exemption 70 of a homes occupants must be. In the case of the income tax. If a resident of Georgia is earning more than 200000 then an.

Payment with Return - Check or Money Order Form 525-TV Extension Payments Form IT-560 Estimated Tax Payment Form 500-ES Application to Request a Payment Plan -. All veterans with a disability rating of 100 are exempt from paying property taxes in the state of Texas. Just enter the wages tax withholdings and other information required.

Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Cost of Turnover Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

No local income tax. This 1099-G form is for. 087 average effective rate.

The top Georgia tax rate has. Yes Georgia residents do pay personal income tax. Georgia uses a progressive tax system for personal income tax with a top rate of 575 for 2022.

How Your Georgia Paycheck Works. Georgia State Tax Quick Facts. Georgia Hourly Paycheck Calculator.

Under Tasks click on Make a Quick Payment. Georgia Payroll Taxes. Review the Request details and click Next.

Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. The Georgia tax code has six different income tax brackets based on the amount of taxable income. 287 cents per gallon of regular gasoline 322 cents.

Single filers who have less than 9700 taxable income are subject to a 10 income tax rate the minimum bracket. Ad Compare 5 Best Payroll Services Find the Best Rates. Make Your Payroll Effortless and Focus on What really Matters.

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Payroll Software Solution For Georgia Small Business

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Taxes On Vacation Payout Tax Rates How To Calculate More

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Pin On Bellsouth Southern Bell Telephone Co

Georgia Paycheck Calculator Smartasset

How To Use A Monthly And Yearly Household Budget Spreadsheet Personal Budget Budget Template Excel Budget Template

Payroll Tax What It Is How To Calculate It Bench Accounting

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Georgia Income Tax Withholdings

How To Calculate Georgia Income Tax Withholdings

2022 Federal State Payroll Tax Rates For Employers

How Pausing The Payroll Tax Will Help Businesses Keep Workers Employed And Paychecks Flowing Georgia Restaurant Association

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

![]()

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica